Pay Tag: A New Way to Experience Spending Through Day-To-Day Spending Data and NFTs

Background: Beyond Simple Data Logging

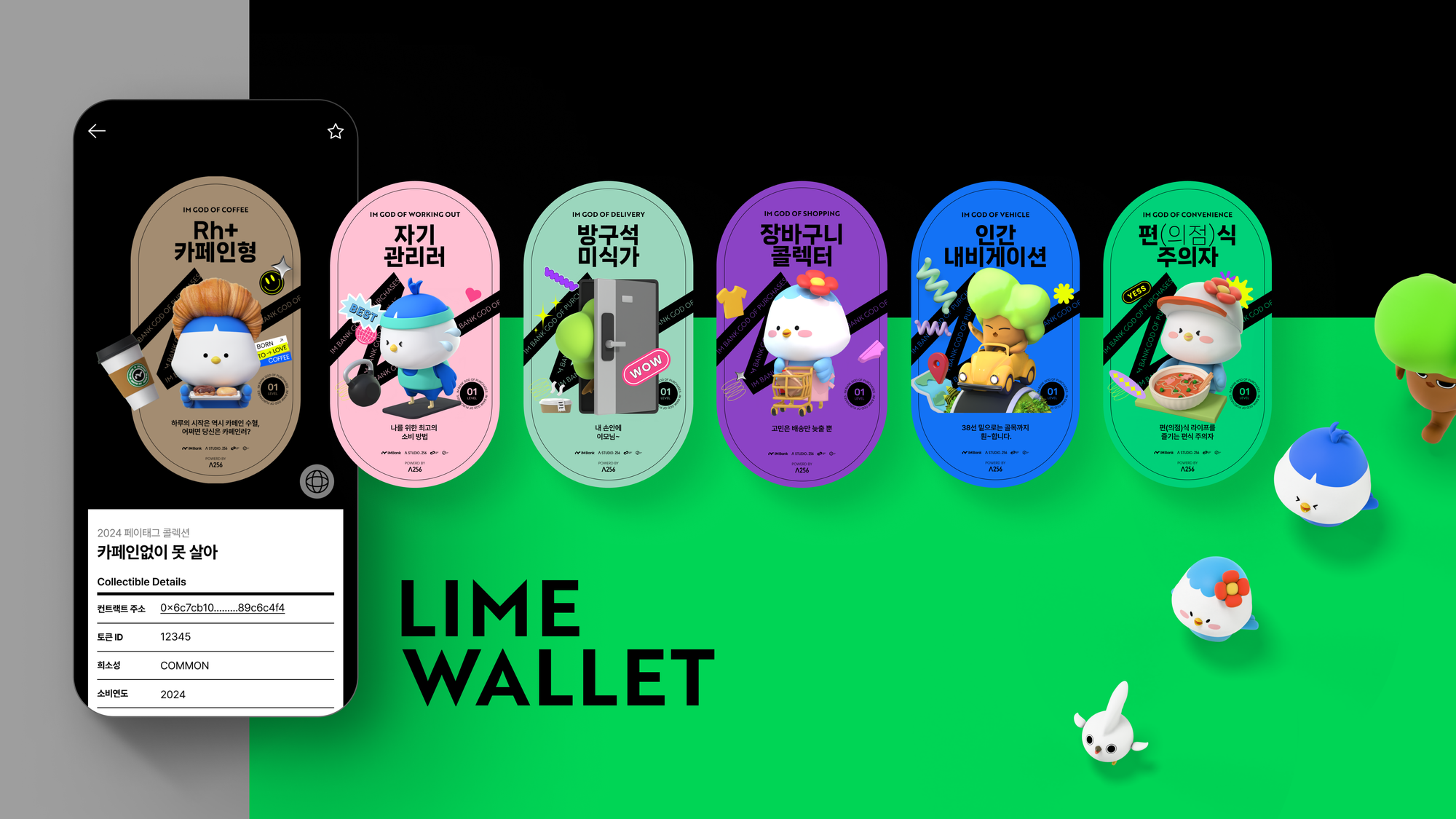

After transforming from a regional bank into a full-fledged national financial institution, iM Bank has focused on digital innovation to differentiate its customer experience. Following the successful launch of LiMe Wallet, a Web3-based digital wallet developed in partnership with STUDIO256, the bank sought the next phase to expand user engagement.

The core challenges were:

- Designing a unique customer campaign leveraging NFTs

- Enabling deeper integration of day-to-day spending data in service offerings

- Acquisition and lock-in of key financial consumer generations

The Solution: 'Pay Tag'—An NFT Campaign Driven by Spending Behavior

To address these needs, STUDIO256 proposed Pay Tag: The God of Spending, an NFT campaign powered by day-to-day spending data.

Instead of simply distributing NFTs, the campaign analyzed each user’s consumption behavior in detail and issued a personalized NFT that visually reflected their spending persona. The result was a seamless customer journey connecting wallet – Day-to-Day Spending Data – NFT – financial service.

The use of endearing character designs and intuitive categorization of consumer spending successfully captured the attention of major financial customers. These elements resonated with users in their daily lives, fostering emotional engagement and encouraging participation. As a result, the campaign contributed to an increase in day-to-day spending data linkages, monthly active users (MAU), and LiMe Wallet adoption.

How It Works: Visualizing Your Day-to-Day Spending Data as an NFT

Users opt in to link their bank accounts and cards via the iM Bank app, granting permission for day-to-day spending data usage. The campaign then analyzes six key spending categories—automotive, food delivery, cafés & desserts, convenience stores, fitness, and online shopping—and issues NFTs based on frequency and volume of consumption.

These NFTs, categorized by rarity (Rare / Super Rare), offer more than just visual novelty:

- Number of users sharing the same NFT

- Personalized dashboards tracking monthly spending

- Benchmarks against the user base

- Historical trends in specific consumption areas

By transforming abstract day-to-day spending data into personalized and visual experiences, the campaign turned everyday spending into something insightful—and even fun—for users.

Beyond simply collecting cute and appealing NFTs that reflect their spending habits, users are offered a unique analytical experience. Within the app, they can view how many others hold the same Pay Tag NFT, access a monthly consumption dashboard, compare their average spending behavior to other users, and review cumulative spending by category. This allows users to gain an engaging and objective understanding of their consumption patterns—without having to manually dig through card statements.

iM Bank didn’t leave users’ daily transactions as mere records. Instead of presenting day-to-day spending data as dull strings of numbers, the bank delivered them as 3D NFTs featuring distinctive characters and witty copywriting. As a result, users could transform their valuable personal day-to-day spending data into something not only useful but also memorable and fun.

The Future Potential of Pay Tag: Persona-Based Insights & Personalized Marketing

Each customer holds a unique wallet address, which stores their personalized Pay Tag NFTs based on their transaction history. Because each NFT also possesses a unique on-chain identifier, customer behavior can be transparently and accurately analyzed. This allows iM Bank to better define customer personas and gain deeper insight into their spending patterns.

Leveraging these insights, iM Bank can recommend tailored financial products aligned with individual consumer preferences. Additionally, industry partners—whether in F&B, fitness, automotive, or beyond—can collaborate to create custom Pay Tags that function as branded digital collectibles. Users are rewarded with new NFTs that reflect their evolving consumption profiles, enhancing brand loyalty, while partners benefit from a cost-effective and agile marketing solution that delivers measurable impact.

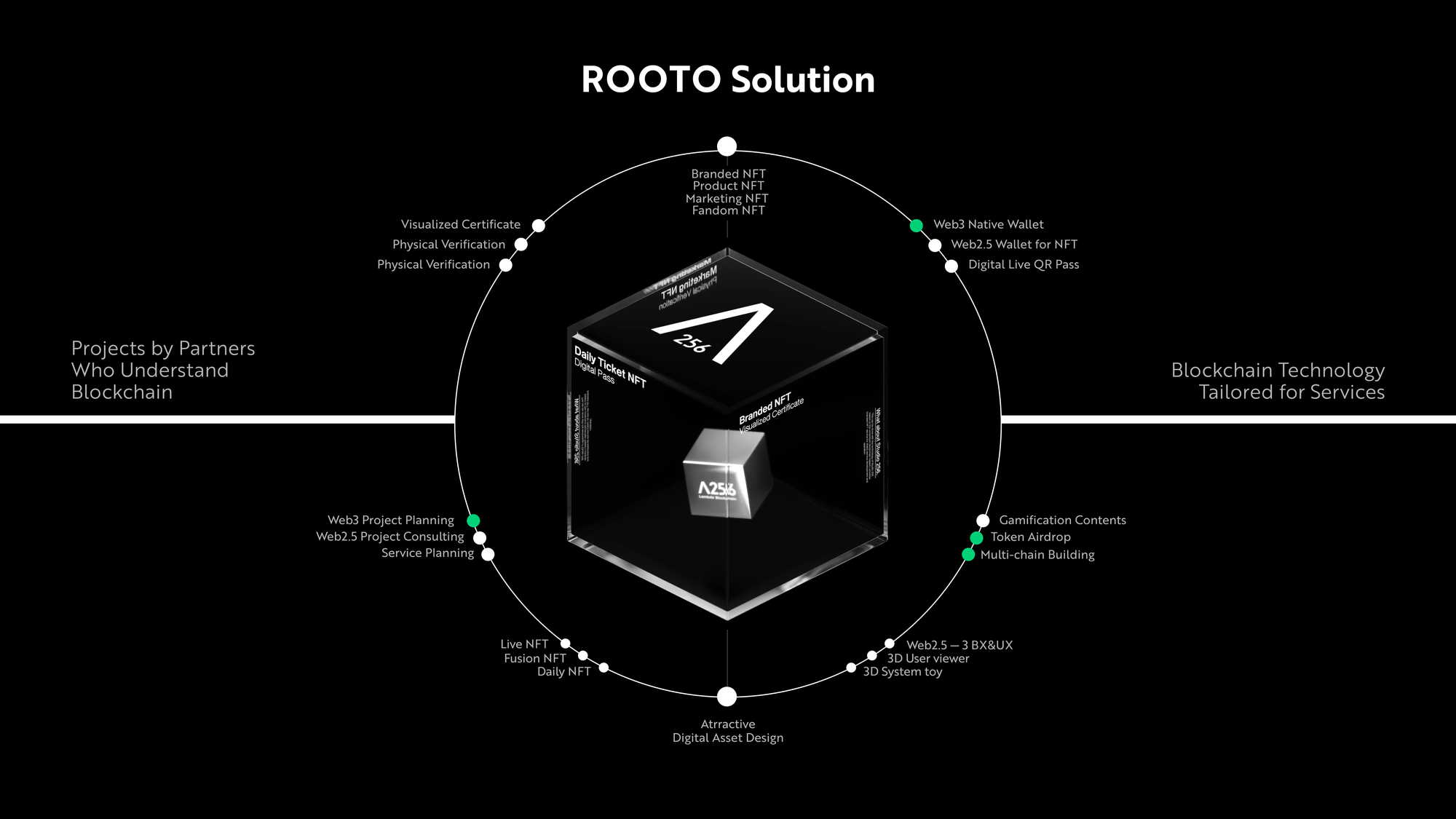

Why Studio256 & Rooto?

Each customer holds a unique wallet address, which stores their personalized Pay Tag NFTs based on their transaction history. Because each NFT also possesses a unique on-chain identifier, customer behavior can be transparently and accurately analyzed. This allows iM Bank to better define customer personas and gain deeper insight into their spending patterns.

Leveraging these insights, iM Bank can recommend tailored financial products aligned with individual consumer preferences. Additionally, industry partners—whether in F&B, fitness, automotive, or beyond—can collaborate to create custom Pay Tags that function as branded digital collectibles. Users are rewarded with new NFTs that reflect their evolving consumption profiles, enhancing brand loyalty, while partners benefit from a cost-effective and agile marketing solution that delivers measurable impact.

Power your financial innovation with Rooto!

📩 Contact Sales: support@lambda256.io