AMA Quick Recap: What Builders Should Know About Arc

TL;DR

- Arc is purpose-built for on-chain finance, focusing on institutional and enterprise-grade use cases rather than being a general-purpose blockchain.

- Stablecoins sit at the core of Arc’s design, with USDC used for gas fees to improve cost predictability and reduce exposure to token volatility.

- Deterministic finality, powered by Malachite, eliminates reorg risk and supports production-grade financial systems.

- Cross-chain interoperability is a priority, with native support for tools like CCTP and Gateway to keep USDC liquidity unified across ecosystems.

- Developer tooling such as Circle Wallets and SDKs abstracts blockchain complexity and enables real-world applications like micropayments and cross-chain workflows.

Greeting builders,

Last Christmas Eve, we closed out the year with a meaningful technical AMA alongside the Arc team. More than 400 builders joined us live, and the session quickly turned into an engaging, thoughtful discussion. The questions were thoughtful and practical, which made it clear how serious the Korean community is about building real, institution-ready infrastructure.

Here is a recap of the key ideas shared by Arc during the session, for full video clip please refer here.

Circle and the Foundation of Stablecoins

HJ opened by outlining Circle’s role in the broader digital asset ecosystem, describing the company as a full-stack financial platform building infrastructure for a global stablecoin network. At the center of this network is USDC, the world’s largest regulated stablecoin, with more than $76 billion in circulation across 30 blockchains as of Nov 2025. She emphasized that every USDC is fully backed by U.S. dollars or cash-equivalent assets, and highlighted Circle’s commitment to transparency through monthly attestations published by a Big Four accounting firm. According to HJ, this level of openness is essential to earning institutional trust and enabling stablecoins to operate at scale.

Why Blockchain Adoption Still Feels Difficult

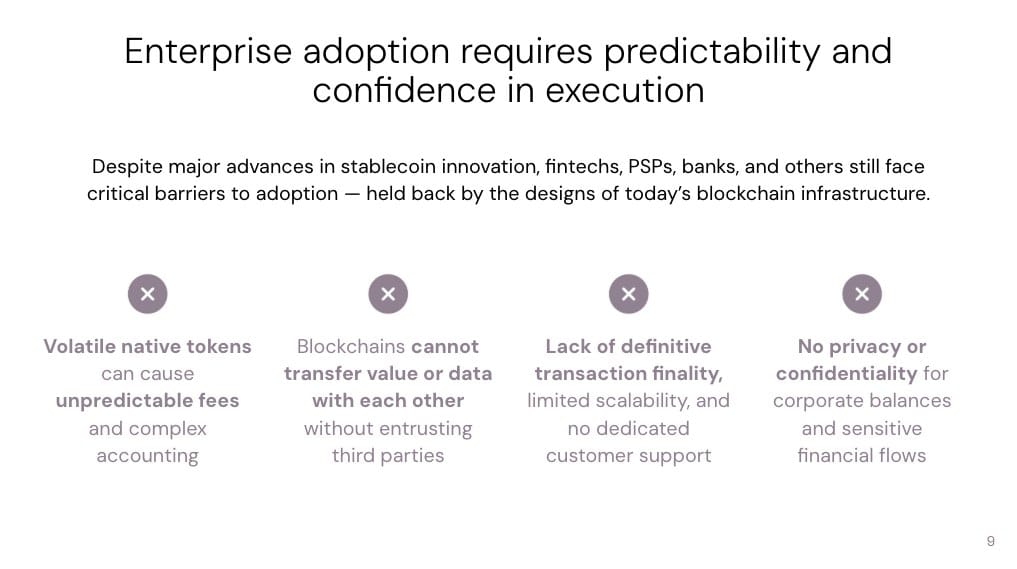

HJ then addressed why blockchain adoption remains challenging for businesses.

One of the biggest hurdles is the need to hold volatile native tokens simply to pay transaction fees, which introduces balance-sheet risk that most companies prefer to avoid. Cross-chain fragmentation adds further complexity, with assets spread across multiple networks and value transfers often dependent on bridges.

From an institutional perspective, HJ also pointed to probabilistic finality as a serious concern, since reorg risk is hard to accept in production-grade financial systems. Privacy was another key issue she highlighted—confidentiality is not optional for enterprise workflows. She explained that these combined challenges are precisely why Arc was created.

Introducing Arc: Purpose-Built for Real Economic Activity

“That’s where Arc comes in. It is an open EVM compatible Layer 1, but it is not trying to be everything for everyone. Arc is built specifically for real economic activity on chain. The team described it as an economic operating system for the internet, something anyone can build on, with a clear focus on moving and settling real value at scale.” said HJ.

Stablecoins at the Core of the Network: Native Gas

Building on this focus on real economic activity, stablecoins sit at the core of Arc’s design through its native gas model.

On Arc, transaction fees are paid in stablecoins rather than speculative tokens. As a result, businesses can operate without exposure to token volatility, making costs far more predictable. In addition, Arc introduces a bounded base fee and fee-smoothing mechanism to keep fees stable over time.

At the same time, network congestion is minimized through sub-second deterministic finality, powered by Arc’s high-performance consensus engine, Malachite. For those interested in the technical details, the Arc Litepaper is now available in Korean to help Korean builders dive deeper into the gas model and system architecture.

Deterministic Finality with Malachite

To meet enterprise requirements, Arc delivers deterministic finality through Malachite, a Rust based implementation of a Tendermint style Byzantine Fault Tolerant consensus algorithm.

At launch, Arc will run on a proof of authority validator model, where finality is achieved as soon as two thirds of validators commit a block. This means transactions are confirmed immediately, removing the risk of chain reorganizations. Malachite is fully open source and publicly available on GitHub under Circle’s organization, supporting transparency and independent review.

Addressing Liquidity Fragmentation and Privacy

Beyond finality, Arc also tries to solve two other real problems: fragmented liquidity and privacy. It does this by natively supporting Circle’s cross chain tools like CCTP and Gateway, which let USDC move across networks without relying on wrapped assets. That helps keep liquidity together instead of scattered across chains. At the same time, Arc offers opt in privacy features, so balances and transactions can be hidden when needed, while still allowing for audits. This kind of setup matters a lot for regulated and institutional users.

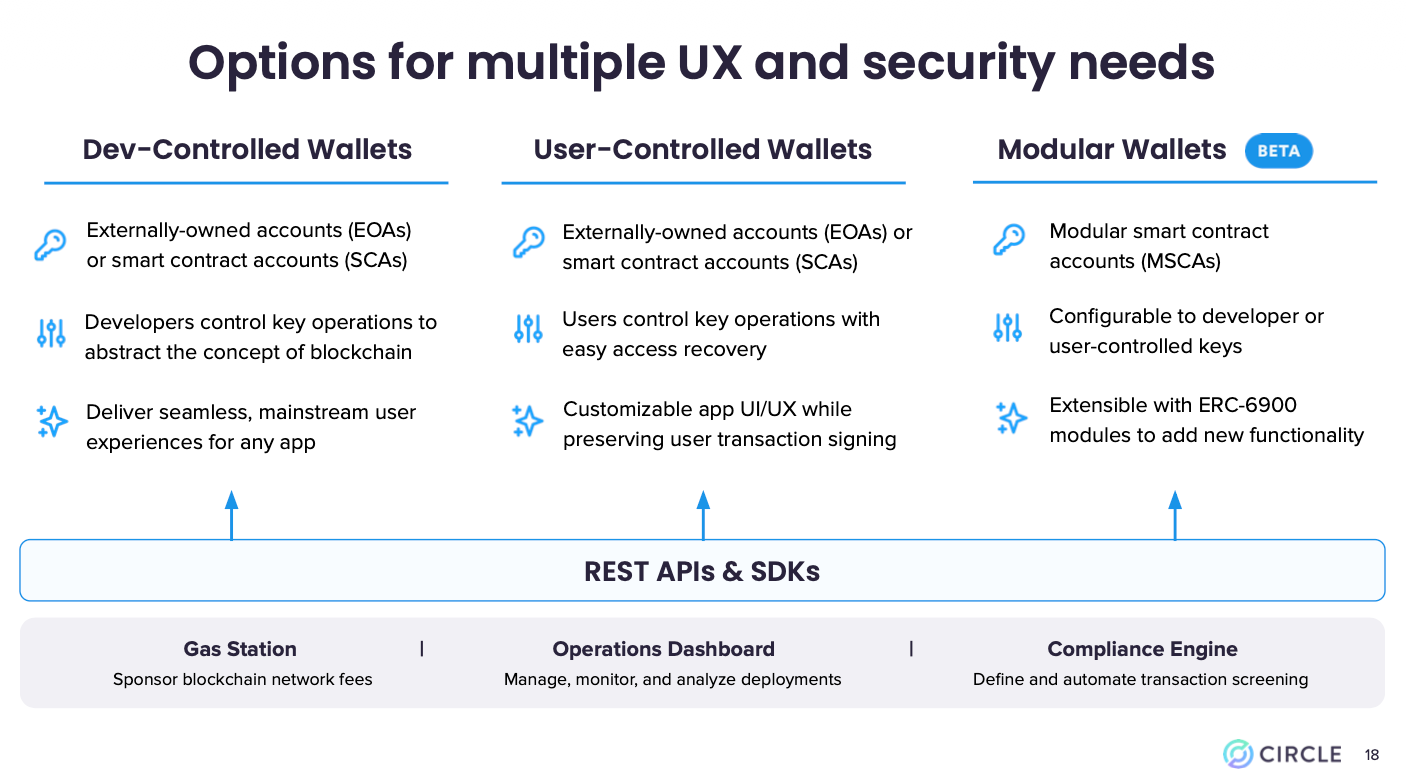

Circle Wallets Overview: Options for multiple UX and Security needs

HJ also outlined how Circle thinks about wallets more broadly. She described wallets as the main entry point for interacting with blockchains, supporting a wide range of use cases across applications and users. Circle offers three different wallet models, each designed for a specific set of needs.

Three wallet models:

- Developer-controlled wallets: Applications manage keys and execute transactions, abstracting blockchain complexity

- User-controlled wallets: End users have full ownership of keys with secure client SDK for authentication and recovery

- Modular wallets: For teams needing deeper customization, combining Circle's orchestration with custom infrastructure

Developer-Controlled Wallets Demo: “How the SDK actually works?

To make things more tangible, the session included a live demo showing how developer-controlled wallets work from start to finish. The goal was to demonstrate how quickly a developer can move from initial setup to real transactions, using familiar tools and a straightforward flow.

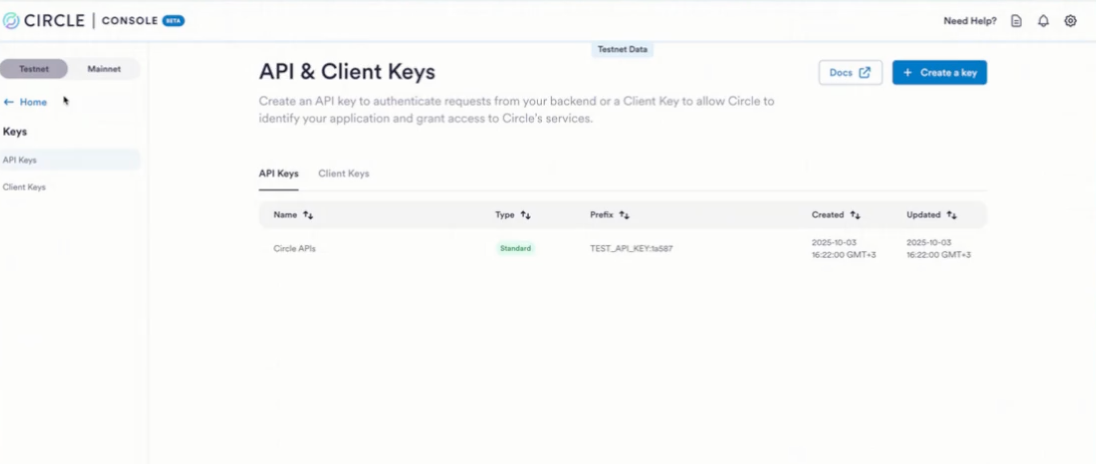

The first step: Sign up on Circle console: https://console.circle.com/signin

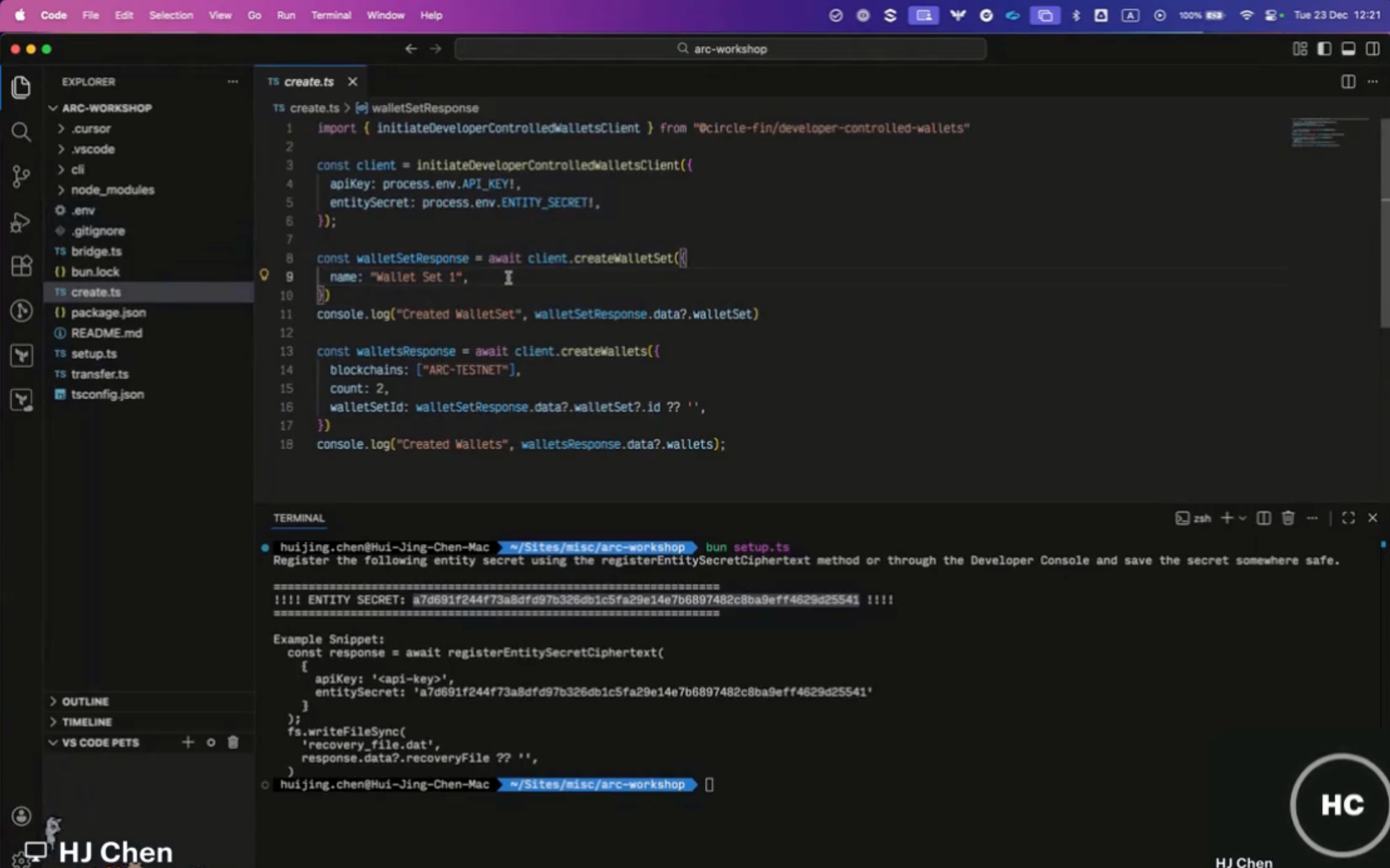

The demo began with the basics: setting up a Circle developer account, generating an API key, and creating a 32 byte entity secret to securely manage wallets. Using the Circle SDK, which supports both Node.js and Python, the team emphasized best practices around credential management, including keeping keys out of source code.

Next, she walked through wallet creation. A wallet set was created as the foundation, from which individual wallets are derived. Each wallet set can support up to 10 million wallets, and for the demo, two wallets were created on the Arc testnet and immediately visible in the Circle console.

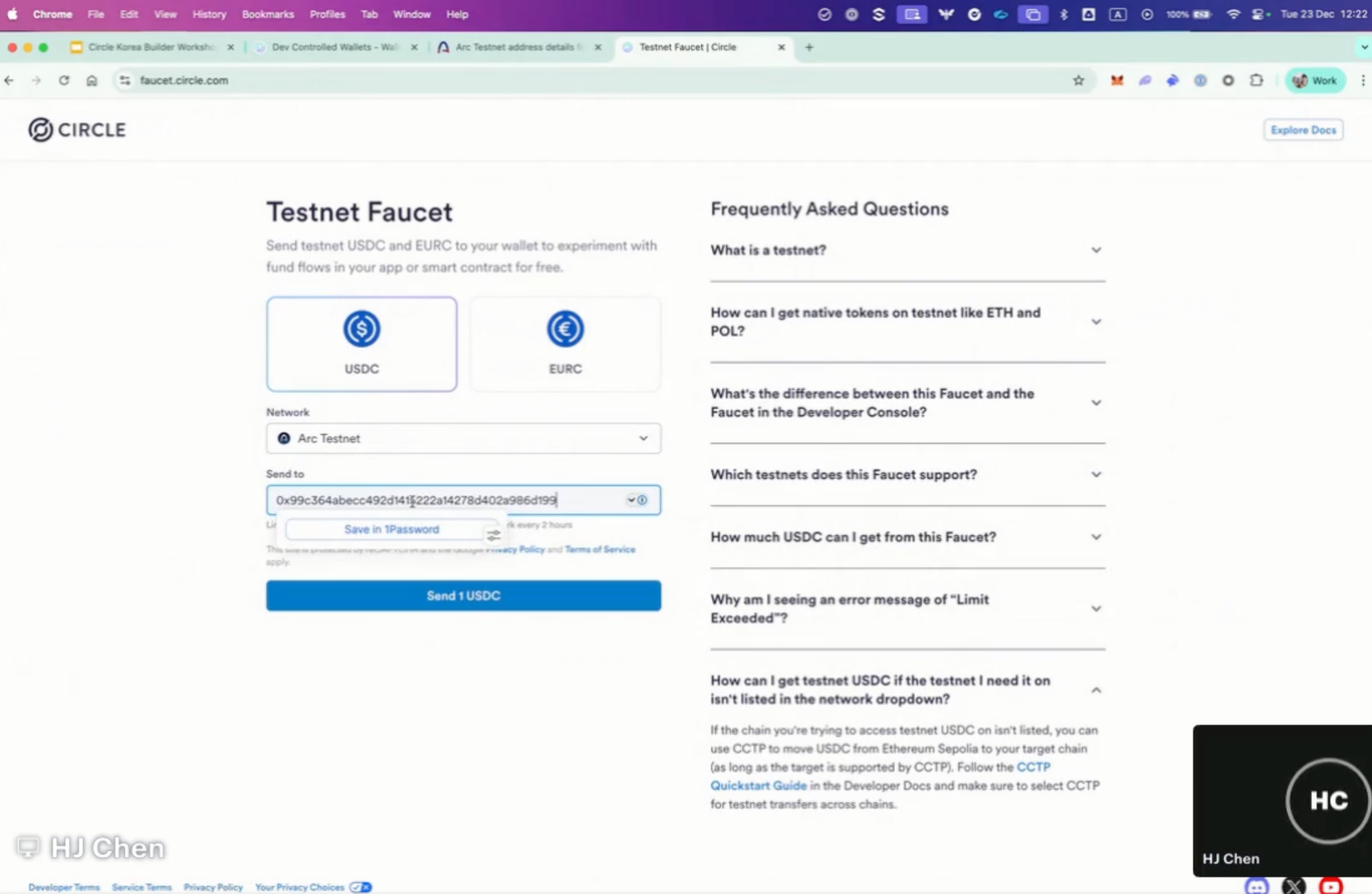

With the wallets in place, the team demonstrated real USDC transactions. After funding a wallet through the testnet USDC faucet, they transferred 0.1 USDC between wallets using the SDK. Gas fees were paid directly in USDC, removing the need to manage a separate native token, and all activity could be monitored directly in the Circle console.

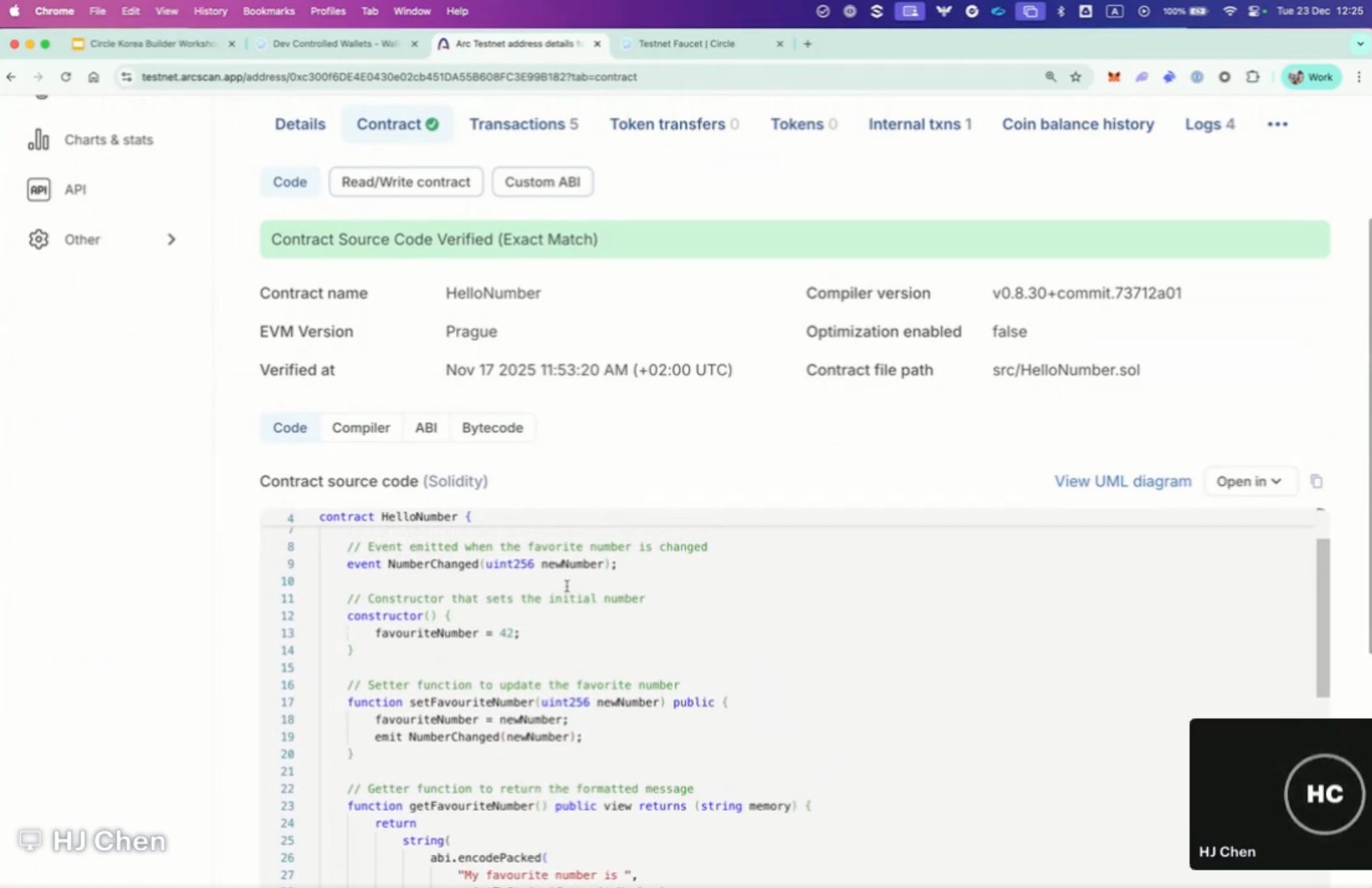

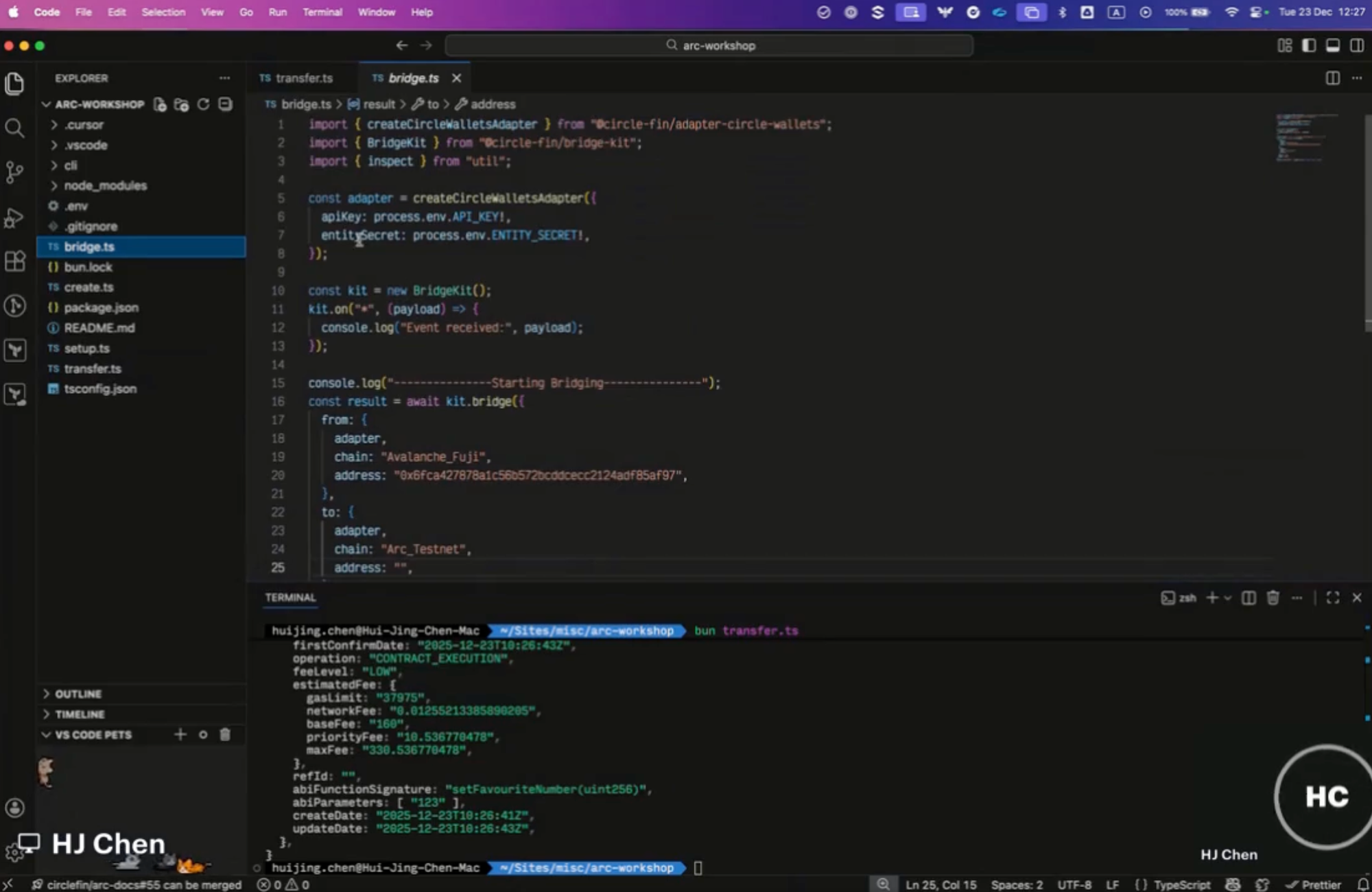

The demo then moved into smart contract interactions. A simple “HelloNumber” contract was deployed on the Arc testnet, and the SDK was used to call its functions, updating a stored value from 42 to 123. This illustrated how the same method can be used to interact with more complex contracts across different blockchains, with the contract and source code visible on the Arc testnet block explorer.

To close, HC showed a cross chain USDC transfer using BridgeKit and CCTP. Ten USDC were transferred from Avalanche to the Arc testnet, with each stage of the process clearly shown. The transfer completed in roughly ten seconds, depending on network conditions.

For whom might interested in the full flow exactly as it happened on screen, check out the recap video to walk through the entire demo step by step (Started from 43:25 ~ 54:18).

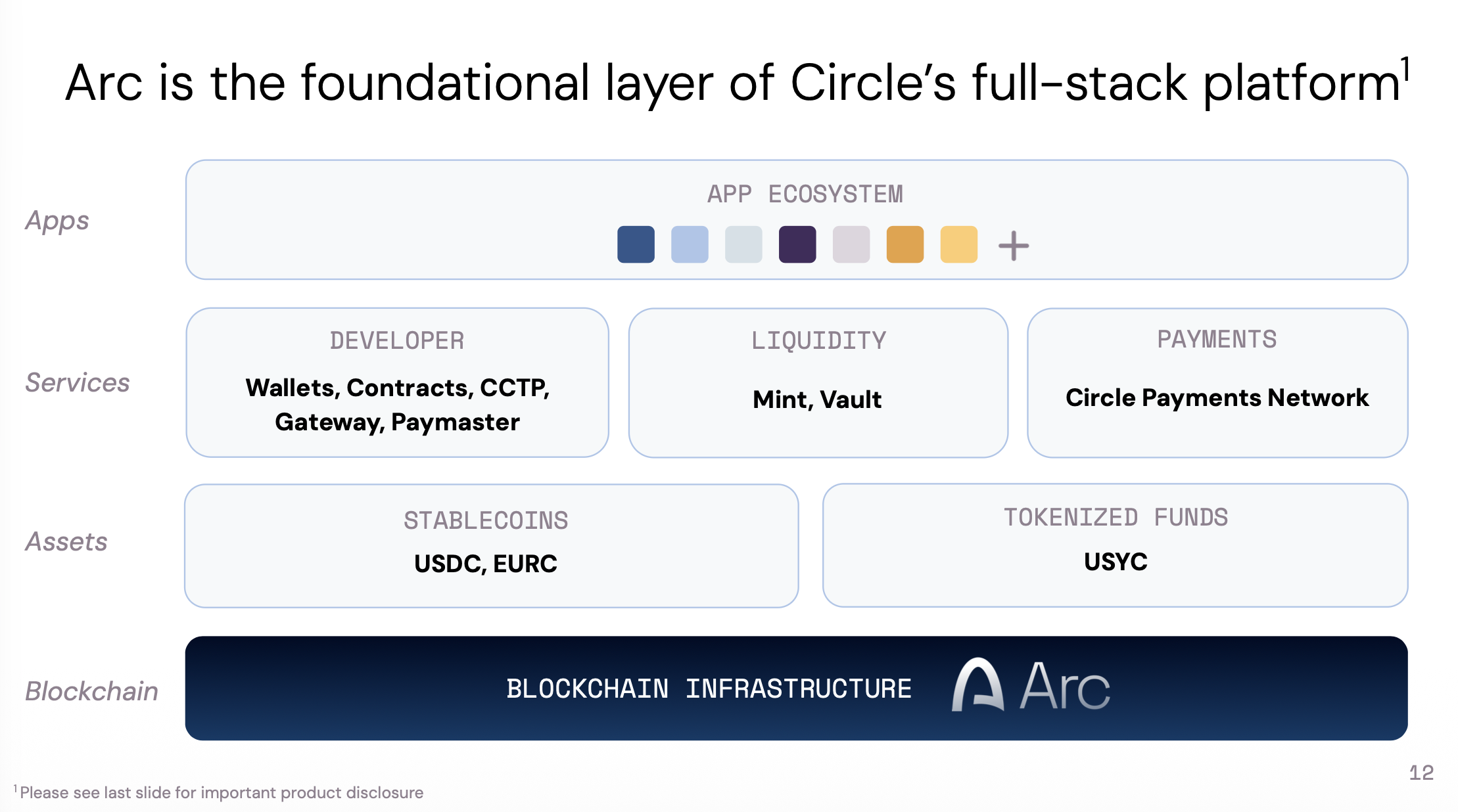

Arc Within Circle’s Full-Stack Platform

As the discussion continued, it became clear that Arc is not meant to stand alone.

Arc serves as the infrastructure layer within Circle’s broader platform. On top of it sit stablecoins and tokenized assets, supported by services like Circle Wallets, CCTP, and Gateway. Above that, a growing ecosystem of applications—ranging from Circle’s own products to partner integrations and third-party apps—builds on these layers to solve real-world problems.

Real-World Applications

Importantly, the Arc team highlighted that a large amount of financial value still lives off-chain today. Arc is designed to help bring more of that value on-chain by supporting use cases like stablecoin-based credit, on-chain settlement for capital markets, and institutional FX infrastructure. One recent example is StableFX, a stablecoin-powered FX engine that Circle has introduced on the Arc testnet and is currently available to approved institutions.

Looking ahead, Arc also enables newer use cases such as agentic commerce, where autonomous systems or IoT devices can transact directly on-chain without human intervention.

Developer Resources

If you’re looking for more technical details, the resources below are a great place to start.

- Circle Developer Docs

- Arc Developer Docs

- Blog posts

Three Notable Questions from the Live Session

Most of the pre-submitted questions were covered in the presentation, and we also received a few additional questions after the session, which are shared below:

Question 1: Arc claims to enhance fee predictability by using stablecoins for gas. However, what technincal mechanisms or architectural features are in place to prevent gas fees from skyrocketing and keep them low, even during the sudden traffic spikes or network congestion?

Answer 1:

When it comes to gas fees, Arc focuses on more than just price stability from using USDC. A key challenge is ensuring fees remain predictable, even during periods of network congestion. While Arc is based on Ethereum’s EIP-1559 fee model, the engineering team has adjusted it to better support real-world usage.

One important change is fee smoothing. Instead of updating the base fee on every block, Arc adjusts fees using a moving average based on block utilization over time. Fees are kept within defined bounds, with additional guardrails that limit how quickly they can increase or decrease.

These design choices help prevent sudden fee spikes. Compared to many blockchains where fees can fluctuate sharply and unpredictably, Arc is designed to keep fee movements tighter and easier to anticipate. For readers who want to dive deeper into the technical details, the Litepaper explains exactly how these calculations work.

Question 2: I heard machine-to-machine payment is possible, but does Arc have a built-in protocol like x402?

Answer 2:

At the moment, Circle is actively contributing to the ecosystem around X402. While it’s not offered as a built-in protocol, developers can already start building with the available tooling. To support this, the team has published several blog posts that walk through practical examples, including how to use X402 with Circle Wallets to enable use cases like micropayments.

Based on what’s available today, this is definitely an area worth exploring for developers who are interested. In parallel, Circle is also conducting ongoing research with the SUCO research team, which recently released an open-source, object-oriented agent kit. For Python developers in particular, this toolkit is publicly available on GitHub and provides a solid starting point for experimenting with agent-based systems.

Circle is also working on Circle Gateway, a smart contract designed to manage unified USDC balances. The team is currently exploring how Circle Gateway could be connected with X402 to support more advanced workflows.

While much of this work has so far been documented in English-only blog posts on Circle’s website, the broader takeaway is clear: the team is very interested in how the X402 ecosystem continues to evolve. Agentic commerce, especially in the context of micropayments and automated transactions, is an area where blockchain can offer real advantages. Circle encourages developers who are curious about this space to explore the tools available today and start building.

Question 3 What were the key design trade-offs Arc made as a purpose-built L1 compared to general-purpose?

Answer 3:

The core features of Arc are intentionally designed with enterprise adoption in mind. Unlike general-purpose blockchains that try to support a wide range of use cases across different industries, Arc is purpose-built for one specific area: on-chain finance. Rather than spreading itself too thin, the goal is to do one thing well instead of many things poorly.

This focus allows Arc to provide features that work especially well for financial use cases, particularly those involving institutions and regulated environments. At the same time, the team recognizes that not every use case belongs on Arc. That’s why there is a strong emphasis on making the movement of USDC across chains as seamless as possible.

From a developer’s perspective, this means it’s easier to move value across different applications and ecosystems without friction. And for end users, much of that complexity is abstracted away. They don’t need to know which blockchains are involved behind the scenes. All they see is the application’s front end and the ability to complete what they need to do using stablecoins.

This is the key design tradeoff behind Arc. The chain is optimized to be the best possible environment for on-chain finance. For use cases that are better suited to other blockchains, Arc aims to make it simple and efficient to move USDC in and out. In this way, Arc balances specialization with interoperability, without forcing every use case onto a single chain.

Thanks to everyone who joined the AMA and shared thoughtful, practical questions. We hope the session helped clarify how Arc works and how it can be applied to real-world use cases. It was great to see so many builders digging into the details and exploring how Arc can be used in practice.

And for team Nodit, we are currently working on integrating Arc into our platform and will be sharing more technical updates, integration details, and announcements along the way. Looking forward to what’s ahead, stay tuned!

🔎About Nodit

Nodit is a platform that provides reliable node and consistent data infrastructure to support the scaling of decentralized applications in a multi chain environment. The core technology of Nodit is a robust data pipeline that performs the crawling, indexing, storing, and processing of blockchain data, along with a dependable node operation service. Through its new Validator as a Service (VaaS) offering, Nodit delivers secure, transparent, and compliant validator operations that ensure stability, performance visibility, and regulatory assurance.

By utilizing processed blockchain data, developers and enterprises can achieve seamless on chain and off chain integration, advanced analytics, comprehensive visualization, and artificial intelligence modeling to build outstanding Web3 products.

Homepage l X (Twitter) l Linkedin

Join us and build more👊🏻

👉Start for Free (Click)