Nodit Supports Arc Testnet for Stablecoin and Payment Infrastructure

TL;DR

- Nodit has started supporting Arc on testnet ahead of its mainnet launch

- Arc is built for stablecoin, payment, and institutional-grade financial use cases

- As the mainnet developed by USDC issuer Circle, Arc reflects deep experience working with institutions and regulated markets

- Nodit recently co-hosted a virtual AMA with the Arc team to support early ecosystem engagement

- Nodit provides institutional-grade infrastructure for Arc, including nodes APIs, and the rest of operational toolings

- With strong operational presence in South Korea, Nodit supports CEXs, wallets, and stablecoin businesses building on Arc

Nodit has begun supporting Arc on testnet, enabling institutions and enterprise teams to explore and prepare for the network ahead of its mainnet launch.

Supporting a network at the testnet stage is not about short-term visibility. It allows infrastructure, operations, and data tooling to mature in parallel with the ecosystem. For institutional builders, this preparation phase is critical to moving into production smoothly once mainnet is live.

Arc is increasingly viewed as one of the most relevant upcoming mainnets going into 2026, particularly for teams focused on stablecoins, payments, and financial infrastructure.

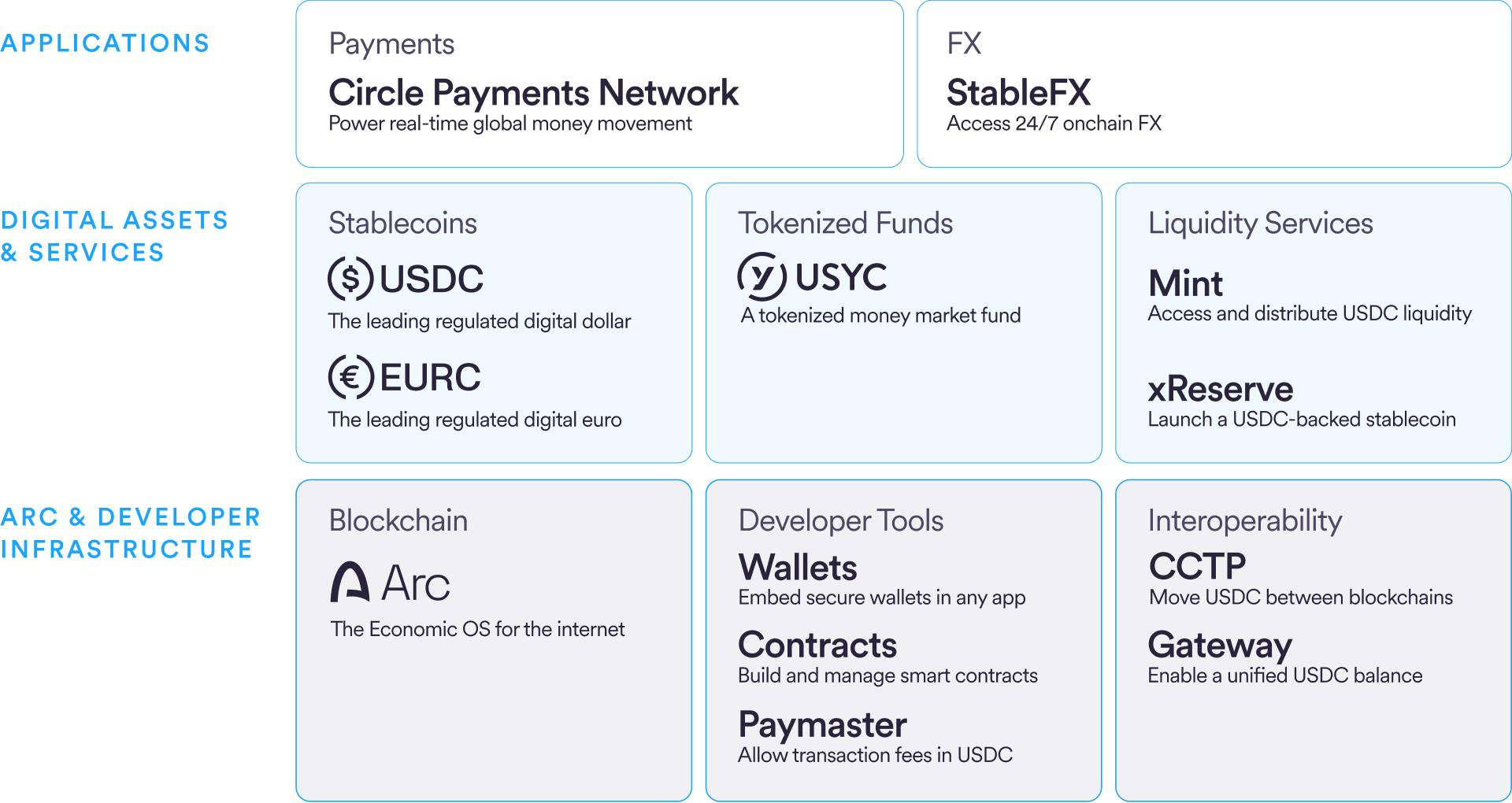

Arc’s Approach to Institutional-Grade Financial Infrastructure

Arc and Developer Infrastructure are designed around real economic activity rather than experimental applications. The network focuses on predictable costs, fast settlement, and security, which are core requirements for institutional and enterprise adoption.

One of Arc’s key design choices is using USDC as native gas, which enables low and predictable transaction fees. This structure helps institutions manage operational costs and reduces exposure to fee volatility. Support for additional stablecoins is planned as the network evolves.

Arc also provides deterministic sub-second finality, enabling near-instant settlement. This is especially relevant for payment services, trading platforms, and financial operations where certainty and speed are essential.

Arc is built by Circle, the issuer of USDC. This background reflects extensive experience working with institutions, regulators, and enterprise partners, as well as a strong understanding of how security, compliance, and financial risk are evaluated in production environments.

Initial Ecosystem Communication and Technical Alignment: First Korean Virtual AMA

As part of early ecosystem support, Nodit recently co-hosted a virtual AMA with the Arc team. The session was designed to help introduce Arc to builders and institutional audiences, clarify the network’s direction, and support early engagement ahead of mainnet.

Rather than a one-off announcement, this AMA reflects a longer-term approach to ecosystem development and infrastructure readiness, especially for teams that require clear communication and technical confidence before committing resources.

View the full recap:

Arc Infrastructure Capabilities on Nodit Platform Nodit Offers for Arc Builders

To support institutional and enterprise teams building on Arc, Nodit provides infrastructure and data services aimed for production environments.

Current support includes

- Elastic Node for scalable workloads

- Dedicated Node for institutional and enterprise setups

- Node APIs (RPC) for stable and reliable access

These offerings help teams move from testing to production without re-architecting their infrastructure stack.

Institutional Infrastructure with a Strong South Korean Presence

South Korea is home to major centralized exchanges (like Upbit), wallet providers, and stablecoin-related businesses. Supporting these organizations requires more than basic infrastructure. It requires reliable node operations, monitoring, and a team that understands institutional expectations.

Nodit has extensive experience supporting large-scale exchanges, wallet infrastructure, and payment-related services. This operational background is particularly relevant for teams building stablecoin or payment applications on Arc, where reliability and security are core requirements.

For institutions, choosing a reliable node operation partner is a foundational decision. Nodit keep taking on that role for enterprisers as well as organization who are building serious financial applications in Korea and across APAC.

Production-Ready Networks Require Institutional-Grade Infrastructure

Arc is positioning itself as a production-ready mainnet for stablecoins and payments. Nodit provides an institutional-grade infrastructure setup designed to support that vision from the earliest stage.

Institutional adoption starts with production-ready networks and infrastructure. With Arc moving toward mainnet, Nodit supports institutions and enterprises building for real-world operations.

As part of this commitment, Nodit operates under SOC 2 Type II–certified controls recently, providing a security and compliance foundation trusted by institutional teams across APAC.

🔎About Nodit

Nodit is an enterprise-grade Web3 infrastructure platform that provides reliable node and consistent data infrastructure to support the scaling of decentralized applications in a multi chain environment. The core technology of Nodit is a robust data pipeline that performs the crawling, indexing, storing, and processing of blockchain data, along with a dependable node operation service. Through its new Validator as a Service (VaaS) offering, Nodit delivers secure, transparent, and compliant validator operations that ensure stability, performance visibility, and regulatory assurance.

By utilizing processed blockchain data, developers and enterprises can achieve seamless on chain and off chain integration, advanced analytics, comprehensive visualization, and artificial intelligence modeling to build outstanding Web3 products.

Homepage l X (Twitter) l Linkedin

🔎About Arc

Arc is an open Layer-1 blockchain purpose-built to unite programmable money and onchain innovation with real-world economic activity.

Engineered for mass adoption, Arc features predictable dollar-based fees using stablecoins as gas, opt-in configurable privacy that supports compliance obligations, and direct integration with Circle’s full-stack platform for secure access to liquidity and powerful developer tooling. This makes Arc uniquely suited for use cases like lending, capital markets, FX, and payments.